Intra-ASEAN trade – Gravity model and Spatial Hausman-Taylor approach

Intra-ASEAN trade – Gravity model and Spatial Hausman-Taylor approach

Phung Duy Quang[1], Pham Anh Tuan[2] and Nguyen Thi Xuan Thu[3]

Abstract

This paper examine determinants of intra-industry trade between Vietnam and Asean countries. By solving endogenous problem and applying Hausman-Taylor model for panel two-way dataset, we detect that export flows of Vietnam gravitate to neigboring countries and those with similar GDP. More importantly, the research indicates the existence of spatial-lag interaction.

Key-word: Intra-trade, export, import, gravity model, two-dimensions fixed effect panel model, Hausman-Taylor model, Spatial Hausman - Taylor model

Date of receipt: 25th Oct.2017; Date of revision: 15th Mar.2018; Date of approval: 1st Apr.2018

Introduction

In the 1930s, the theory of Ricardo was extended and modeled by two economists Eli Heckscher and Bertil Ohlin. Heckscher-Ohlin model of international trade was developed based on differences in production factors between countries. In some countries labor is abundant but capital is scarce, while in many other countries capital was in surplus but labor was in shortage. As a result, these countries would specialize in manufacturing and exporting commodities which the country has comparative advantage (Eli F. Heckscher & Bertil Ohlin, 1933). However, the model could not explain characteristics of the more developed international trade. One of the characteristics is intra-industry trade. For example, US exports Ford cars to Japan and Europe but also imports cars from Japan and Europe such as BMW or Toyota. This fact is unexplained by the comparative advantage theory. The theory of comparative advantage does not explain why some economies such as Taiwan and South Korea have succeeded in the transition from exporting clothes, shoes in the 1960s to exporting computers, cars to America and Europe today. Intra-industry trade is plausible as export and import might happen at the same time in the same industry. It was explained by the role of monopolistic competition in product differentiation (Frenstra and Taylor, 2011). The explanation is based on assumptions about economies of scale, in which the large-scale production reduces production costs. Besides advantages of large scale production, it also assumes consumers’ interest in product diversity. Intra-industry trade was known as a phenomenon in the expansion of trade between Western Europe and the United State after World War II. There are two types of intra-industry trade consisting of horizontal intra-industry trade driven by product differentiation and vertical intra-industry trade driven by international fragmentation of the production. Accounting for approximately one-third of world trade (Reinert KA, p. 53), intra-industry trade has become an important part of world trade. Through participation in intra-industry trade, a country can simultaneously reduce the number of types of self-produced products and increase the variety of goods to consumers in the local market. In the mid 1980s, some emerging economics such as China, Hong Kong, Indonesia, Malaysia, Philippines, Singapore, South Korea, Taiwan and Thailand constituted over 20 percent of intra-industry trade in East Asia (Helvin, 1994). From mid 1970s to mid 1990s, intra-industry trade reached to approximately 50 percent from 25 percent (Thrope, M and Z. Zang, 2005). Intra-regional trade in world trade increased 3.1 times, and East Asia expanded by 6.7 times during the same period between 1981 and 2001. This demonstrated intra-industry trade playing an increasing important role of the world economy in general and of the region in particular (Mitsuyo Ando, 2006).

In the past few decades, since the implementation of DoiMoi program in 1986, the Vietnamese Government has pursued a policy of liberalization and market-oriented pricing, better exchange rate management, modernized financial systems, tax reform and fair competition between private enterprises and monopoly state-owned enterprises. Consequently, Vietnam's economy has achieved high GDP growth, macroeconomic stability, trade promotion, investment and poverty reduction. The economic achievements of Vietnam in the last decade have been impressive, thanks to the policy of trade liberalization associated with international economic integration. Vietnam became a member of the Association of Southeast Asian Nations (ASEAN) in 1995, and joined the World Trade Organization (WTO) in 2007. Currently, the focus of the commercial strategy of Vietnam in ASEAN is to negotiate bilateral and regional trade agreements. ASEAN is a regional integration organization promoting economic development, culture and society regionally and internationally. The determination to build an ASEAN Community comprising three pillars which are the Political-Security Community, Social-Cultural Community, and Economic Community represents a new step in the process of cooperation among ASEAN countries. The ASEAN community, including ASEAN Economic Community (AEC) was officially established on 31.12.2015. This community brings ASEAN into a single market and production base; an equal regional development; competitive economic sector and strong integration into the global economy. Vietnam has actively participated in the integration of AEC activities, especially activities aimed at liberalizing trade in goods and services. Although Vietnam is not at the level of high development compared to some countries in the region, according to the grading of ASEAN, over the period of 2008 through 2013, Vietnam is one of three best countries, which fulfill the commitments in the AEC Blueprint. This fact has motivated us to explore determinants of intra-industry trade flows between Vietnam and ASEAN countries in recent years. In order to meet this objective, we apply Hausman-Taylor Estimation in Heterogeneous Panels.

- Literature review

- Previous researches on world trade

In the last decade, Vietnam has actively integrated into the world market, which was evidenced by its WTO membership and its conclusion of some regional and bilateral free trade agreements (FTA). Among them, the ASEAN Free Trade Agreement (AFTA) is the most important regional FTA. To analyze the impacts of various factors on internal trade in the sectors between Vietnam and other ASEAN member countries, the authors used the gravity model. This model was initiated by Tinbergen (1962) and Poyhonen (1963) and widely applied in experimental studies to quantify commercial impact of the economic linkages bloc. They concluded that exports are positively affected by the income of the trading countries and that distance can be expected to negatively affect to exports. In the later years, in 1979, Anderson applied product differentiation referred to the Armington Assumption which implied that there is imperfect substitutability between imports and domestic goods, based on the country of origin. He assumed Cobb-Douglas preferences and these products differentiated by country of origin. Gravity model of international trade flows has been widely used as a base model to calculate the impact of a range of policy issues relating to regional trade groups, monetary union and various trade distortions. Bergstrand (1985, 1989) also identified the theories of bilateral trade in a series of articles in which the gravity equation has been associated with simple monopolistic competition models. Since the seminal study by Anderson (1979), several efforts have been made explicitly to derive the estimation of gravity model from different theoretical models as Ricardian or Heckscher-Olin model and Increasing Returns to Scale model, for example Bergstrand (1990), Markusen and Wigle (1990) and Leamer (1992). Baldwin (1994a) indicated that industrial goods could be applied for gravity models because industrial goods generally appear to be useful to exhibit increasing returns to scale which can result in significant two-way trade of similar products between industrialized countries. More recently Deardorff (1995) demonstrated that the gravity equation characterizes many models and can be adjusted from the basic trade theory. There are a large number of practical applications in the materials of international trade, which has contributed to the better performance of gravity equations. For instance, Mátyás (1997),Chen and Wall (1999),Breuss and Egger (1999)improved the econometric specification of the equations of gravity. Anderson and Wincoop (2001) derived a gravity model based on the operation of the CES expenditure system that can be easily estimated and helps to solve the mutual border issue. Helpman (1998) concluded that the primary advantage of using gravity models is to identify determinants influencing on volume of trade and some underlying causes for trade. Helpman believed that many trade theories would not explain volume of trade in the best way. He supposed that the gravity equation is considered to work best for similar countries with considerable intra-industry trade between them, rather than for countries with different factor endowments and a predominance of inter-industry trade. Helpman suggested that product differentiation can be beyond factor endowments.

The results of previous studies on intra-industry trade are mixed. On one hand, most current econometric studies have explained the positive relationship between the share of intra-industry trade and the average level of per capita income. Higher average per capita income, which represents a higher 'level of economic development', raises the extent of demand for differentiated products and increases the share of intra-industry trade. On the other hand, some econometric studies have found a negative correlation between countries' average tariff and/or nontariff barrier levels (custom union dummies) and the share of intra-industry trade (see Pagoulatos and Sorensen (1975), Loertscher and Wolter (1980), Havrylyshyn and Civan (1983), Balassa and Bauwens (1987).

In recent years, many studies have carried out in-depth analysis on the impact of the FTA by gravity model. Baier and Berg (2002) added to the model of the FTA dummy variable and indicated that the FTA has made trade flows to increase four times. Carrere (2003) applied the research of Berg and Baier into analyzing panel data. The results indicated that the FTA has created a significant increase in trade compared to the previous results. Urata and Okabe (2007), Gulhot (2010) also used the gravity model to examine the impact of FTAs in East Asia. The variables in the model include GDP, per capita income, geographical distance and some dummy variables to assess the level of creation and trade diversion of FTAs in East Asia as well as to review the impact of individual factors on trade flows of the economy. Applying gravity model for trade in services, Kimura and Lee (2004) concluded that the gap between the partner countries plays an important role for trade in services than trade in goods but unexplained how it happened.

2.2. Earlier Researches on Trade in Vietnam

In Vietnam, there have been many studies using gravity models to assess the impact of FTAs that Vietnam participated. Thai (2006) analyzed trade between Vietnam and 23 countries in Europe (EC23) through gravity model and panel data. Variables included in the model are GDP of Vietnam and partner countries, population, exchange rates, geographical distance and history dummy. Tu Thuy Anh and Dao Nguyen Thang (2008) evaluated the factors affecting the level of concentration of Vietnam trade between ASEAN +3 countries. The model deployed in the study included three groups of factors that affect trade flow, including the group of factors affecting supply (GDP and population of the exporting country), the group of factors affecting demand (GDP and population importing country) and the group of attractive factors or prevention (geographical distance). Nguyen Anh Thu (2012) used a gravity model to examine the impact of the economic integration of Vietnam under the ASEAN Free Trade Agreement (AFTA) and the Economic Partnership Agreement Vietnam-Japan (VJEPA) on Vietnam's trade. The dependent variables in the model are GDP, the gap between countries, per capita income, the real exchange rate and the dummy variables VJEPA, AFTA, AKFTA.

The gravity model has achieved undeniable success in explaining the types of international and inter-regional flows, including international trade in general and intra-industry trade in particular by applying varying types such migration, foreign direct investment and more specifically to international trade flows. Prediction of gravity model researches about bilateral trade flows depends on the economy scale and the gap between countries. According to this model, exports from country i to country j are explained by their economic sizes (GDP or GNP), their populations, direct geographical distances and a set of dummies incorporating some kind of institutional characteristics common to specific flows.

- Methodology

3.1. Gravity model

Grubel and Lloyd index (GL Index) (Grubel and Lloyd) is enormously popularity for analysis of intra-industry trade. This index is considered the most appropriate evaluation of commercial structure in a specific period. It is calculated by the following formula:

where: IIT is intra-industry index; is export and is import; i denotes commercial good; j and k are export and import country respectively; n is the number of items that the two countries trade with each other.

IIT index has a value between 0 and 1, IIT equal 0 means that the trade between countries j and k is completely inter-industry trade; if the value is 1 trade between countries j and k is completely intra-industry trade. If IIT value is ≥ 0.5, trade between countries j and k mainly due to intra-industry trade caused. Otherwise, IIT <0.5 is mainly due to the impact of inter-industry trade.

Gravity model is an effective tool to formulize the volume and direction of bilateral trade between countries and widely used in international trade (Matyas 1997). The key assumption of this model, which is the commercial activities, complies with Newton's theory of gravity. Particularly, the intensity of trade between two countries is positively related to the size and inversely related to the geographical distance of the two countries. Standard equation is:

Where: is trade flow between countries i and j, M represents measured volume (size), D is a distance between countries (or economic centers) and G is a constant.

It has become widely recognized that Gravity model has a number of advantages compared with other models because of the following reasons: (i) relative easiness in finding data, (ii) a transparent and simple function, thus makes sense in economic terms, (iii) the fact of the event and (iv) the ability to highly interpret and assess the impact of various factors separately for international trade, which may separate the effects of the free trade agreement (FTA). However, there are some limitations associated with the use of a standard gravity model, including: (i) the sustainability of the economic functional form of model is a question mark, (ii) there may exist an endogenous relationship between changes in trade flows and the formation of the agreement (increasing trade leads to the formation of the agreement rather than the opposite. This endogenous problem can be solved through causality test or Hausman-Taylor estimation).

3.2. The Hausman-Taylor Panel Data Model

This paper explores the determinants of intra-industry trade flows between Vietnam and ASEAN countries in recent years and draws some implications on how Vietnam could integration more effectively as well as take advantage of being an ASEAN member in the field of trade. A gravity model of international trade is empirically tested to investigate the relationship between the volume and direction of international trade and the formation of regional trade blocs where members are in different stages of development. We apply our proposed Hausman Taylor (HT) estimation technique along with the conventional panel data approaches. There are some additional advantages of using the panel data rather than cross-sectional data or time series data. Besides handling both changing issues across the country at a time (cross-sectional) and changes over time, panel data can allow us to control impact of heterogeneity (abnormal movements which are consistent, but are not observed and measured among the economies over time). The fixed effects (represented by such variables as the constant distance between all exporters/importers) can be estimated directly, as opposed to the random effects (variables with specific distribution function), usually based on a strong assumption that the unobserved effects do not correlate with the observed effects. Another advantage of HT is to avoid the potential bias of the uncorrected estimates. This extended panel data setup generalizes HT estimation, develops the underlying economectric theory, and proposes an alternative source of instruments in addition to the (internal) instruments suggested by HT; namely, some of (consistently estimated) heterogeneous time-specific factors under the assumption that they are correlated with individual specific variables but not with unobserved individual effects. We specify model as follows:

3.3. Spatial Hausman-Taylor Panel Data Model

Baltagi et al (2016) introduces spatial spillovers in total factor productivity by allowing the error term across firms to be spatially interdependent. In order to make allowance for spatial correlation in the error term, this model is estimated by extending the Hausman-Taylor estimator. Baltagi also found an evidence of positive spillovers across firms and a large and significant detrimental effect of public ownership on total factor productivity. We will refer to the spatial Hausman-Taylor model to solve our model in case of spatial correlation between regions or countries.

- Explanatory Data

The export and import data of Vietnam are based on data from Ministry of Industry and Trade (2015). The data covers exports and imports of goods from Vietnam to its trading countries in ASEAN region including Brunei, Cambodia, Indonesia, Lao PRD, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam. The data is annual over the twenty seven year in the period 1987-2014, running over countries and sectors. The gross domestic product (GDP) at current price (US$) and population of home and foreign countries are obtained from World Bank database. GDP deflator index is from World Bank World Development Indicators and IMF data source. GDP per capita (already converted in constant dollars) and nominal exchange rate between currencies are from the World Bank World Development Indicators. Data on the distance between the capital of Vietnam (Hanoi) and the capital of where Vietnam exported to is used to capture the distance from Vietnam to different countries; all distances are indicated according kilometers in the form of logarithm. The data collected on the distance calculated from the website Prokerala.com. The gravity model uses distance to model transport costs which is not only a function of distance but also of public infrastructure. We use Liner shipping connectivity index since 2004 (maximum value in 2004 = 100) to captures how well countries are connected to global shipping networks. It is computed by the United Nations Conference on Trade and Development (UNCTAD) based on five components of the maritime transport sector: number of ships, their container-carrying capacity, maximum vessel size, number of services, and number of companies that deploy container ships in a country's ports. The import and export price index of United States are collected from Federal Reserve Bank of St. Louis.

Furthermore, the standard gravity model is augmented with a number of variables to test whether they are relevant in explaining trade. These variables are specified in three dimensions. Firstly, the basic model specifies that or trade depends on the variable measured by real GDP and population of home and foreign countries. Barrier to trade is measured by distance. Secondly, we consider the augmented specification, where trade flows are also allowed to depend on variables that take into account free trade agreements as well as dummy for common border. Finally, due to recent developments of the New Trade Theory advanced by Helpman (1987), Hummels and Levinsohn (1995) and Egger (2001, 2002), we thus add variables such as RLF and SIM. The difference in terms of relative factor endowments proxied by per capita GDPs between two countries is measured by the variable RLF and when there is equality in relative factor endowments, it takes a minimum value of zero. The larger is this difference, the higher is the volume of inter-industry which leads to the total trade will be, and the lower the share of the intra-industry trade.

The relative size of two countries in terms of GDP is captured by the variable SIM. The value is bounded between zero which is absolute divergence in size and 0.5 which is equal country size. The larger this index is (meaning that the more similar two countries are), the higher the share of the intra-industry trade will be.

Real exchange rate in constant dollars at 2010 are defined as , where is nominal exchange rate between currencies h and f in year t in terms of dollars.

- Empirical Application to the Intra-EU Trade

4.1 Explanatory Data Analysis

Figure 1: Share of Intra-ASEAN on ASEAN trade

Source: Author’s estimation

Figure 1 shows that the intra-ASEAN trade has always been a considerable part of ASEAN’ s total trade. Although the share of intra-ASEAN on ASEAN trade fluctuates within 12 years from 2004 to 2015, it still accounts for nearly two-thirds total trade of ASEAN. Beginning at 65% on total trade in 2004, the share of intra-ASEAN declined dramatically in the following 5 years. In 2010, the figure returned to original position, continually increased to 66% in 2012 before declining slightly to 59% in 2015 due to price increases in primary goods

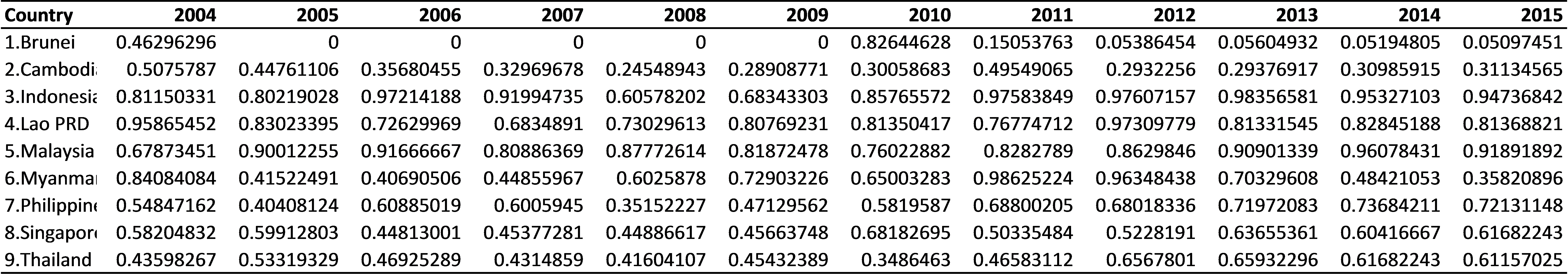

Table 1. Share of Intra-ASEAN by ASEAN countries

Source: Author’s estimation

In general, it can be seen that intra-industry trade in Vietnam and other countries in Southeast Asia have gradually increased fluctuations, which reflects monopolistic competition market and diversity in tastes of consumers about export and import of products with similar quality. In trading relations with Vietnam, Indonesia, Lao PRD and Malaysia are the countries have the highest intra-industry trade share with an average of more than 80% per year in the period 2004-2015, which followed by Singapore, the Philippines, Myanmar ... and Brunei accounts for least share of intra-industry trade with Vietnam

The values of SIM variable are more than 0 and towards 0.5. This demonstrates that there is a positive correlation between the intra-industry trade share and SIM. The values of RLF is quite big, it means there has a clear difference in terms of relative factor endowments proxied by per capita GDPs between two countries. The larger is this difference, the higher is the volume of inter-industry which leads to the total trade will be, and the lower the share of the intra-industry trade. In other words, we find a negative correlation between the intra-industry trade share and RLF, and a positive correlation between the intra-industry trade share and SIM. As Helpman (1987) indicated that it is interpreted as supporting evidence of the theory of IRS and imperfect competition in international trades.

4.2 Estimation results

The research considers both dimensions of panel data, namely spatial and time dimensions. Firstly, in terms of spatial one, we run a Hausman test to designate FE or RE. The observed value is 34.21 with statistically significant level at 0.000; therefore, FE will be used.

Table 2. Estimation results of models concerning spatial effects and time effects

|

Spatial effects |

Time effects |

||

|

Variable |

Coefficient |

Variable |

Coefficient |

|

LnGDPh |

-0.0573 (0.952) |

LnGDPh |

1.1125 (0.753) |

|

LnGDPf |

0.1481 (0.151) |

LnGDPf |

-0.89 (0.000) |

|

Lnpoph |

24.931 (0.000) |

Lnpoph |

8.097 (0.478) |

|

Lnpopf |

-8.7343 (0.000) |

Lnpopf |

2.074 (0.000) |

|

Sim |

5.896 (0.000) |

Sim |

2.457 (0.051) |

|

RLF |

0.2575 (0.277) |

RLF |

0.516 (0.003) |

|

RERF |

2.9755 (0.000) |

RERF |

5.27 (0.001) |

|

RERH |

9233.5 (0.424) |

RERH |

11423.64 (0.788) |

|

LnDist |

|

LnDist |

-1.555 (0.000) |

|

F-test |

197.3 (0.000) |

|

|

|

Hausman |

34.21 (0.000) |

Hausman |

0.23 (0.9998) |

Source: Author’s estimation

Column 2 of table 2 presents results of model concerning spatial dimension. Variable lndist is constant over time so that it is removed from the model. As can be seen in column 2, coefficients of variables Lnpoph, Sim, and RERF are statistically significant. While the coefficient of lnpopvn is positive, that of lnpopf is negative. It means that in ASEAN trade, population of countries does not matter for export to them. More interestingly, populated countries are not as attractive as those with less population. Additionally, positive and significant coefficient of Sim indicates that countries with similar GDP are more attractive to each other than those with different GDP.

Column 4 of table 2 shows results of model concerning time dimension. Different from the model with spatial dimension, this model designates random effects. Positive and significant coefficient of lnpopf indicates that over time countries with large population are more attractive to export products than those with less population. Especially, coefficient of lndist is negative and is statistically significant at . This detects a fact that countries nearby are Vietnam are more attractive than other countries. Positive and significant coefficient of Sim helps to reconfirm the attractiveness of countries with similar GDP.

Table 3. Estimation results of Hausman-Taylor Model and Spatial Hausman-Taylor model

|

Hausman-Taylor Model |

Spatial Hausman-Taylor model |

||

|

Variables |

Coefficient |

Variable |

Coefficient |

|

TVendogenous |

|||

|

LnGDPvn |

-0.169 (0.86) |

LnGDPvn |

4.518 (0.054) |

|

Lnpopvn |

23.417 (0.00) |

Lnpopvn |

-5.29 (0.100) |

|

TVexogenous |

|||

|

LnGDPf |

0.119 (0.24) |

LnGDPf |

-0.9283 (0.006) |

|

Lnpopf |

-6.92 (0.00) |

Lnpopf |

2.232 (0.003) |

|

Sim |

5.48 (0.000) |

Sim |

2.403 (0.465) |

|

RLF |

0.196 (0.402) |

RLF |

0.5 (0.273) |

|

RERF |

2.51 (0.000) |

RERF |

6.193 (0.036) |

|

RERH |

11075.25 (0.334) |

RERH |

-45563.8 (0.16) |

|

TIexogenous |

|||

|

LnDist |

1.153 (0.919) |

LnDist |

-2.099 (0.053) |

|

|

|

Moran’I |

0.582 (0.000) |

|

|

|

LME |

0.6056 (0.43) |

|

|

|

LMLag |

1636.2 (0.000) |

|

Hausman test |

6.52 (0.0891) |

Test-HT |

1.8974 (0.8316) |

Source: Author’s estimation

Table 3 represents estimated results of Hausman-model and spatial Hausman-Taylor model. The tests on the existence of spatial interaction Moran’I and LM Lag are both statistically significant at . It means that there is spatial lag interaction. We use Hausman test to see whether FE spatial model or HT spatial model should be used. Observed value of the test is insignificant at . Thus HT spatial model is designated. As can be seen in column 4, coefficient of endogenous variable Lngdph is positive and significant at . It illustrates that GDP of Vietnam has a positive impact on export of Vietnam. Moreover, the negative and statistically significant coefficient of lndist reconfirms results in the model with panel data concerning time dimension. Results in column 4 show that coefficient of LnGDPf is negative and statistically significant at and that of Lnpopf is positive and statistically significant at . This leads to a suggestion that gravity of high GDP countries to Vietnamese goods is weaker than countries with low GDP. Additionally, in ASEAN, exports of Vietnam tend to be high in more populated countries.

- Conclusions

Since Vietnam became a member of ASEAN in 1995, it has actively increased intra-trade with countries in the regions. This paper explores the determinants of intra-industry trade flows between Vietnam and ASEAN countries in the recent years through Hausman Taylor (HT) estimation technique along with the conventional panel data approaches.

Estimation results indicate that in the short run, the population of import countries is not the crucial determinant for the export flow into these countries. However, in the long run more populated countries seem to attract more goods flows. In terms of GDP, Vietnam tends to export to countries with similar level of GDP. Concerning the spatial issue, neighboring countries of Vietnam are more attractive to export from Vietnam than other countries.

Reference

- Anderson, P.S. (1979), “A Theoretical Foundation for the Gravity Equation,” American Economic Review, 69, 106-116

- Anderson J.E. and E. van Wincoop (2001), “Gravity with Gravitas: A Solution to the Border Puzzle,” NBER Working Paper 8079.

- Baldwin, R. E. (1994 a). ”Towards an Integrated Europe”, Ch. 3: Potential Trade Patterns, CEPR, pp. 234.

- Baier and Bergstrand (2002), “On the Endogeneity of International Trade Flows and Free Trade Agreements”, American Economic Association annual meeting

- Balassa and Bauwens, L. (I987).'Intra-industry specialization in a multi-country and multi-industry framework.'ECONOMIC JOURNAL, December, vol. 97.

- Baltagi, B.H., Egger, P.H. and Kesina, M. (2016), “Firm-level productivity spillovers in China’s chemical industry: A spatial Hausman-Taylor approach” Journal of applied econometrics, 31, 214-248.

- Bergstrand, J.H. (1985), “The Gravity Equation in International Trade: Some Microeconomic Foundations and Empirical Evidence,” The Review of Economics and Statistics, 71, 143-153.

- Bergstrand, J.H. (1989), “The Generalized Gravity Equation, Monopolistic Competition, and the Factor-Proportions Theory in International Trade,” The Review of Economics and Statistics, 67, 474-481

- Bergstrand, J.H. (1990), “The Heckscher-Olin-Samuelson Model, the Linder hypothesis and the Determinants of Bilateral Intra-industry Trade,” Economic Journal, 100, 1216-29

- Breuss, F., and Egger, P. (1999), “How Reliable Are Estimations of EastWest Trade Potentials Based on Cross-Section Gravity Analyses?”Empirica, 26 (2), 81-95

- Carrere, Céline (2006), “Revisiting the Effects of Regional Trade Agreements on Trade Flows with Proper Specification of the Gravity Model”, European Economic Review, 50 (2), 223-247.

- Chen, I-H., and H.J. Wall (1999), “Controlling for Heterogeneity in Gravity Models of Trade,” Federal Reserve Bank of St. Louis, Working Paper 99010A.

- Deardorff, A.V. (1995), “Determinants of Bilateral Trade: Does Gravity Work in a Neo-Classic World?” NBER Working Paper 5377

- Do Tri Thai (2006), “A Gravity Model for Trade between Vietnam and Twenty-three European Countries”, Unpublished Doctorate Thesis, Department of Economics and Society, HögskolanDalarna, 14

- Eli F. Heckscher&Bertil Ohlin (1933), “Heckscher-Ohlin Trade Theory”, 1st publish

- Egger, P. (2001) “On the Problem of Endogenous Unobserved Effects of the Gravity Models,” Working Paper Austrian Institute of Economic Research, Vienna.

- Egger, P. (2002), “A Note on the Proper Econometric Specification of the Gravity Equation” Economics Letters, 66, 25-31.

- Federal Reserve Bank of St. Louis (2016), “Export and Import price index USA”. Accessed on 14th Available at: https://fred.stlouisfed.org/series/IQ

- Frenstra and Taylor (2011), “International Economics”, 2nd edition, Worth Publisher, chapter 6, 167-198

- Gulhot, L (2010), “Assessing the Impacts of the Main East Asia Free Trade Agreements using a Gravity Models: First Results”, Economics Bulletin, Vol. 30, No. 1, 282.

- Havrylyshyn, 0.andCivan, E. (I983). 'Intra-industry trade and the stage of development: a regression analysis of industrial and developing countries.', pp. 111-40

- Hellvin L., (1994), “Intra-Industry Trade in Asia”, International Economic Journal, 27–40.

- Helpman, E. (1987), “Imperfect Competition and International Trade: Evidence from Fourteen Industrialized Countries”, Journal of the Japanese and International Economies, 1, 62-81.

- Helpman E. (1998). ”The Structure of Foreign Trade”, Working Paper 6752, NBER Working Paper Series, National Bureau of Economic Research.

- Hummels, D. and J. Levinsohn (1995), “Monopolistic Competition and International Trade: Reconsidering the Evidence,” Quarterly Journal of Economics, 110, 798-836

- Kimura, F., and H. H. Lee (2004), “The Gravity Equation in International Trade in Services”, European Trade Study Group Conference, University of Nottingham.

- Leamer, E. (1992), “The Interplay of the Theory and Data in the Study of International Trade,” in Issues in Contemporary Economics, 2, New York University Press

- Loertscher, R. and Wolter, F. (I980).'Determinants of intra-industry trade: among countries and across industries.'WeltwirtschaftlichesArchiv, vol. I i6, Pp. 281-93

- Markusen, J. and R. Wigle (1990), “Expanding the Volume of North-South Trade,” Economic Journal, 100, 1206-15.

- Matyas, L. (1997), “Proper Econometric Specification of the Gravity Model,” The World Economy, 20, 363-68

- Mitsuyo Ando (2006), “Fragmentation and vertical intra-industry trade in East Asia, North American Journal of Economics and Finance”, 259

- Nguyen Anh Thu (2012), “Assessing the Impact of Vietnam’s Integration under AFTA and VJEPA on Vietnam’s Trade Flow , Gravity Model Approach”, Yokohama Journal of Sciences, 17 (2012) 2, 137

- Reinert KA (2012), “An Introduction to International Economics: New Perspectives on the World Economy”, Cambridge University Press.

- Thorpe, M. and Z. Zhang (2005), “Study of the Measurement and Determinants of Intra-Industry”

- Tinbergen, J. (1962), “Shaping the World Economy. Suggestions for an International Economic Policy” New York

- TuThuy Anh and Dao Nguyen Thang (2008), “Factors affecting the level of concentration of the Vietnam trade with ASEAN+3”, Center for Economic Research and Policy - University of Economics, Vietnam National University, Hanoi

- Pagoulatos, E. and Sorensen, R. (1979). 'Two-way international trade: an econometric analysis.' WeltwirtschaftlichesArchiv, vol. 111, pp.454-65

- Poyhonen, P. (1963), “A Tentative Model for the Volume of Trade between Countries,” WeltwirtschaftlichesArchiv 90, 93-99.

- Urata, S. and Okabe, M. (2007), “The Impacts of Free Trade Agreements on Trade Flows: An Application of the Gravity Model Approach”, RIETE Discussion Paper Series 07-E-052

The authors would like to sincerely thank Prof. Nguyen Khac Minh for giving valuable comments.

[1] PhD. Foreign Trade University. Email: Địa chỉ email này đang được bảo vệ từ spam bots. Bạn cần bật JavaScript để xem nó.

[2] Vietnam Military Medical University

[3] Diplomatic Academy of Vietnam